idaho state income tax capital gains

Taxes capital gains as income and the rate is a flat rate of 323. Additional State Capital Gains Tax Information for Idaho.

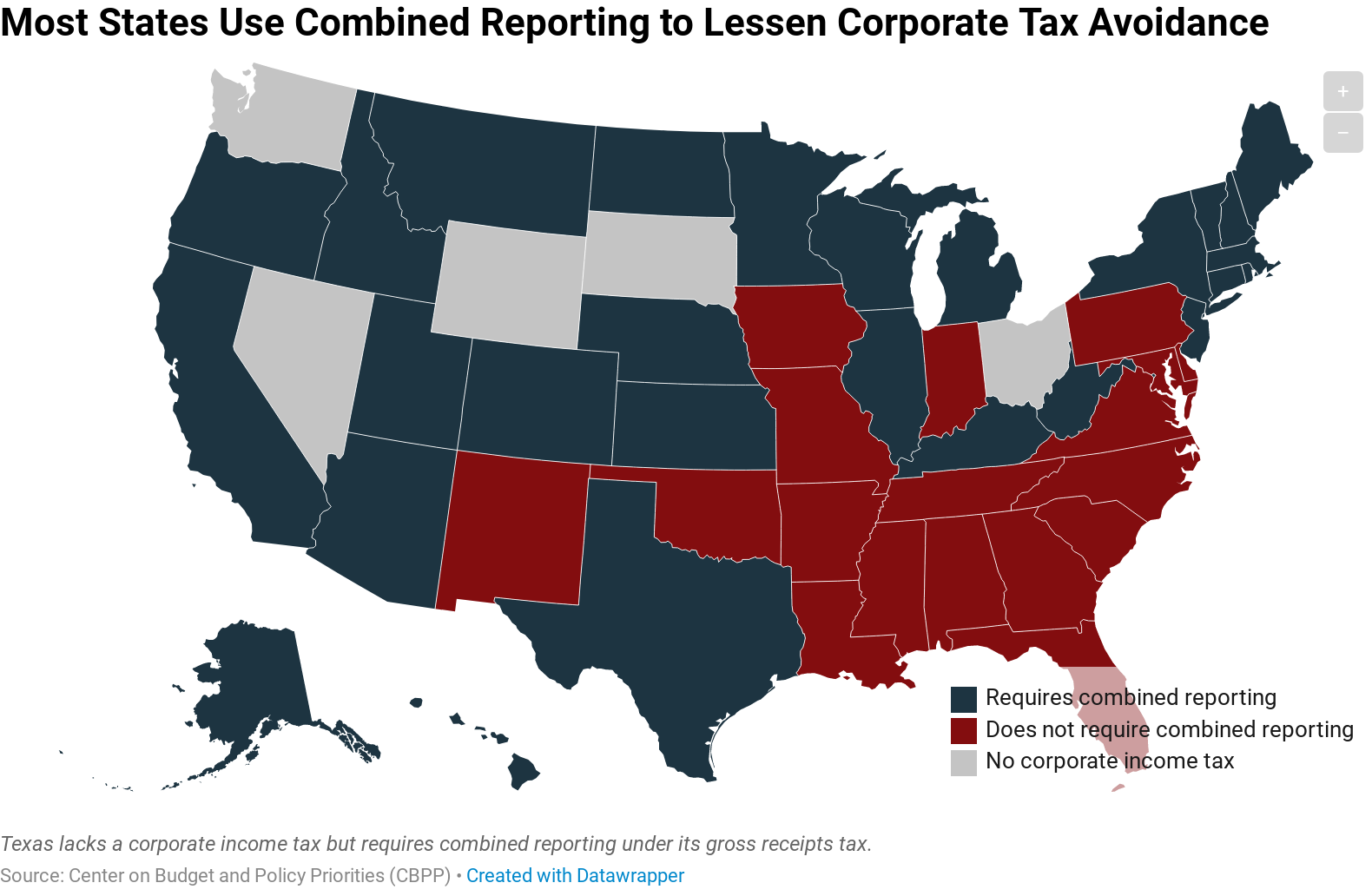

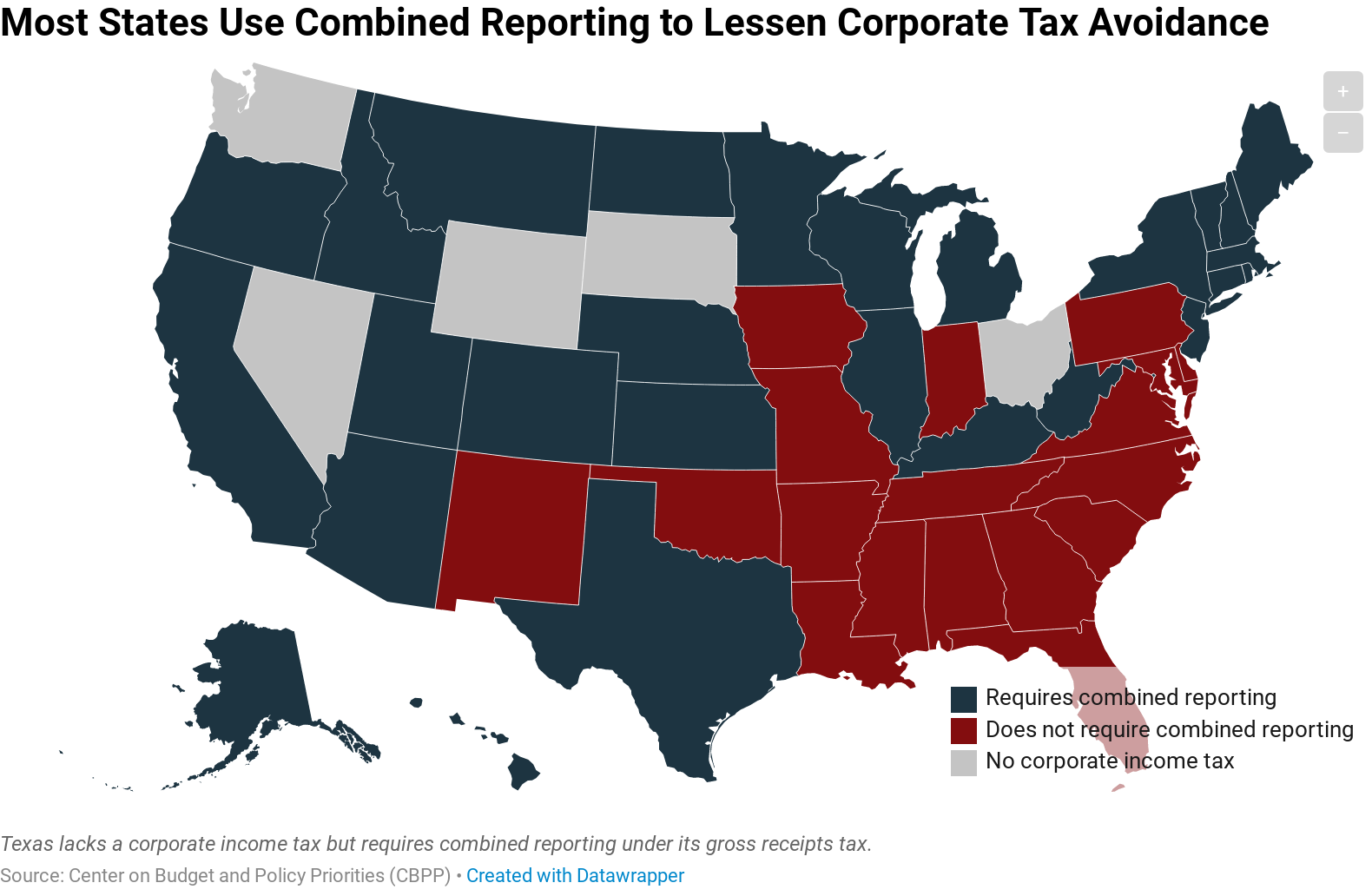

Combined Reporting Lessens Corporate Tax Avoidance At State Level Itep

In Idaho the uppermost capital gains tax rate was 74 percent.

. Idahos capital gains deduction Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property. Capital Gains Tax in Idaho. 208 334-7846 taxreptaxidahogov httpstaxidahogov.

While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income. Taxes capital gains as income and the rate reaches 575. Taxes capital gains as income and the rate reaches 575.

Box 36 Boise ID 83722-0410 Phone. We last updated Idaho FORM CG in January 2022 from the Idaho State Tax Commission. Idaho taxes all your income including income from sources outside Idaho.

Keep a home in Idaho for the entire tax year and spend more than 270 days of the year in Idaho. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent. If you live and invest in areas with high capital gains taxes think about the possibility of a 1031 Exchange as a wealth management strategy.

The percentage is between 16 and 78 depending on the actual capital gain. Real property that is held for at least one year is eligible for a deduction of 60 of the net capital income that is the net gain after expenses. The rate reaches 693.

Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more information on this rule. Therefore the taxpayers Idaho capital gains deduction is limited to the capital gain net income included in taxable income of two thousand five hundred dollars 2500 not sixty percent 60 of the capital gain net income from the qualified property. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income.

Idaho home sellers need to understand how these rate limits on capital gains taxes will affect their investment. You might be entitled to a credit for taxes paid to another state if some or all the income taxed by Idaho is also. For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income.

However certain types of capital gains qualify for a deduction. In Idaho the uppermost capital gains tax rate was 74 percent. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent.

Idahos maximum marginal income tax rate is the 1st highest in the United States ranking directly. Joe Millers family lives in Idaho. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

A capital gain rate of 15 will apply should your taxable income be at least 80000 but less than 441450 for single filers 496600 for married filing jointly or qualifying widower 469050 if you plan to file as head of household and 2483000 if you. Idaho Capital Gains Tax. This form is for income earned in tax year 2021 with tax returns due in April 2022.

The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates. Capital gains are taxed as regular income in Idaho and subject to the personal income tax rates outlined above. Taxes capital gains as income and the rate is a flat rate of 495.

The combined uppermost federal and state tax rates totaled 294 percent ranking tenth highest in the nation. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. Are domiciled in Idaho for the entire tax year.

Zero percent 15 percent or 20 percent. If you are in the 396 bracket your long-term capital gains tax rate is 20. Like the Federal Income Tax Idahos income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Idaho government. Taxes capital gains as income and the rate reaches 66. The rate reaches 693.

Are capital gains taxed in Idaho. Additional State Capital Gains Tax Information for Idaho. File Now with TurboTax.

208 334-7660 or 800 972-7660 Fax. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Idaho axes capital gains as income.

Before investing consider each states capital gains tax rate and the state income tax rate. The capital gains rate for Idaho is. Capital gains are taxable at both the federal and state levels.

Idaho collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Idaho does have a deduction of up to 60 of the capital gain net income of qualifying Idaho property. Taxes capital gains as income and the rate is a flat rate of.

Capital gains for farms is complicated. 9 hours agoIt proposed This measure would repeal a 7 excise tax on annual capital-gains above 250000 by individuals from the saleexchange of stocks and certain other capital assets the tax exempts. The table below summarizes.

Idaho axes capital gains as income. 2 days agoShort-term capital gains are taxed at the same rate as federal income taxes which can be up to 37 while the highest long-term capital gains. State Tax Commission PO.

Taxpayers with adjusted gross incomes above 250000 filing jointly or 200000 filing individually may be subject to an additional 38 Medicare tax on investment income as a result of the Patient Protection and Affordable Care Act. Because this is a farm it is impossible forme to figure the actual exact tax rate for this sale.

States That Won T Tax Your Retirement Distributions Income Tax Income Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Historical Idaho Tax Policy Information Ballotpedia

State Corporate Income Tax Rates And Brackets Tax Foundation

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

How High Are Capital Gains Taxes In Your State Tax Foundation

2022 State Income Tax Rankings Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

The 10 Best And Worst States To Retire In 2017 Clark Howard Clark Howard Retirement Bankrate Com

Lowest Highest Taxed States H R Block Blog

States With Highest And Lowest Sales Tax Rates

State By State Guide To Taxes On Retirees Tax Retirement Retirement Income

The States With The Highest Capital Gains Tax Rates The Motley Fool

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)